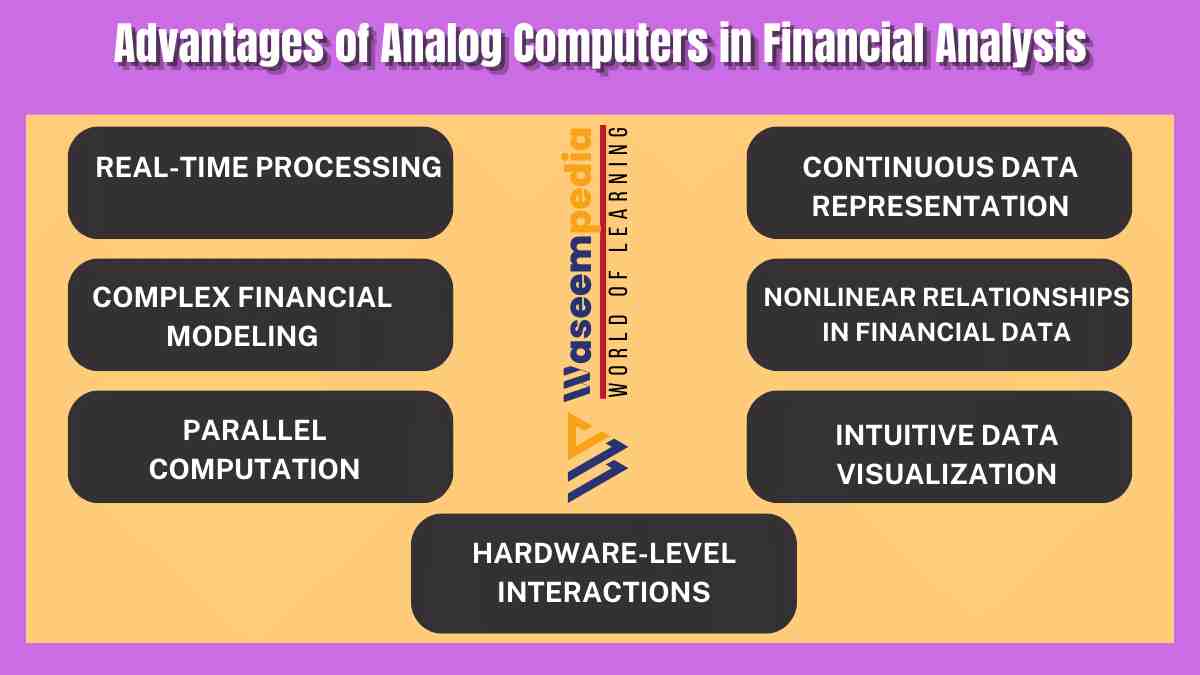

Analog computers offer significant advantages in financial analysis, including real-time processing, continuous data representation, complex financial modeling, capturing nonlinear relationships, parallel computation, intuitive data visualization, and hardware-level interactions.

While digital computers and software applications have become the standard tools in financial analysis, analog computers continue to provide valuable insights and contribute to more accurate financial analysis. The combination of analog and digital approaches can enhance the understanding of financial data and facilitate informed decision-making.

Analog computers have proven to be valuable tools in financial analysis, offering distinct advantages that make them relevant in this field. Financial analysis involves the evaluation of financial data, performance metrics, and market trends to make informed investment decisions and assess the financial health of companies.

While digital computers and sophisticated software dominate financial analysis, analog computers provide unique benefits that can enhance the analysis process. In this article, we will explore the advantages of analog computers in financial analysis and understand their significance in this domain.

Financial analysis is a critical aspect of investment management, risk assessment, and corporate finance. It involves the examination and interpretation of financial data to derive meaningful insights and make informed decisions.

While digital computers and software applications have become the primary tools in financial analysis, analog computers offer unique advantages that complement the capabilities of digital systems. By leveraging the continuous nature of analog computation, analog computers provide valuable insights and contribute to more accurate financial analysis.

what is analog computer?

Analog computers process information using continuous physical quantities, such as voltages or currents, to represent and manipulate data. Unlike digital computers that operate on discrete values, analog computers can directly model and simulate the behavior of financial data and markets. In the context of financial analysis, analog computers offer a different approach to understanding and interpreting financial information.

7 Advantages of Analog Computers in Financial Analysis

7 Advantages of Analog Computers in Financial Analysis are as following

1. Real-Time Processing

Real-time processing is essential in financial analysis, as it requires immediate analysis and response to rapidly changing market conditions. Analog computers excel in real-time processing due to their ability to work with continuous data streams without the need for digitization or discretization.

This real-time capability allows analysts to monitor market data, perform calculations, and make investment decisions in real-time, facilitating timely and informed actions.

2. Continuous Data Representation

Analog computers utilize continuous data representation, enabling analysts to work with the fine-grained details of financial data. Continuous data representation preserves the fidelity of financial information without the quantization errors associated with digital systems.

Analog computers provide a more accurate representation of financial phenomena, allowing analysts to analyze and interpret financial data at a deeper level.

3. Complex Financial Modeling

Financial analysis often involves complex modeling of financial systems and market dynamics. Analog computers are well-suited for modeling these complex systems, as they can directly simulate the continuous behavior of financial variables.

By leveraging the continuous nature of analog computation, analog computers can accurately capture the interdependencies and interactions within financial systems, enhancing the accuracy and realism of financial models.

4. Nonlinear Relationships in Financial Data

Financial data often exhibits nonlinear relationships, making their analysis and interpretation challenging using traditional mathematical methods. Analog computers are particularly effective in capturing and analyzing nonlinear relationships in financial data.

The continuous and parallel nature of analog computation allows for more accurate modeling and simulation of nonlinear financial dynamics. Analog computers enable analysts to study the effects of nonlinear phenomena, such as market volatility or investor sentiment, and enhance the understanding of complex financial patterns.

5. Parallel Computation

Analog computers are inherently parallel computing machines, capable of performing multiple computations simultaneously. This parallel processing capability is advantageous in financial analysis, where numerous calculations and simulations need to be performed concurrently.

Analog computers can efficiently handle the parallel nature of financial data and computations, enabling analysts to process large amounts of data in parallel and accelerate the analysis process.

6. Intuitive Data Visualization

Analog computers offer an intuitive approach to data visualization in financial analysis. Analysts can physically connect and manipulate analog components to visualize financial data and market trends. This hands-on interaction allows for a deeper understanding of the relationships and patterns within financial data.

Analog computers provide an intuitive platform for analysts to explore and experiment with data visualization techniques, facilitating more effective and engaging financial analysis.

7. Hardware-Level Interactions

Analog computers enable hardware-level interactions in financial analysis. Analysts can directly interface analog computers with physical data sources, such as sensors or market data feeds, allowing for real-time data collection and analysis.

This hardware-level interaction enhances the accuracy and timeliness of financial analysis, as analysts can evaluate market conditions and assess data in real-time with direct connections to physical components.

Related FAQ’s

How do analog computers differ from digital computers in financial analysis?

Analog computers process continuous data and directly model financial behavior, while digital computers operate on discrete values and rely on algorithms for financial analysis.

What advantages do analog computers offer in financial analysis?

Analog computers excel in real-time processing, continuous data representation, complex financial modeling, capturing nonlinear relationships, parallel computation, intuitive data visualization, and hardware-level interactions

Why is real-time processing important in financial analysis?

Real-time processing enables analysts to monitor market data, perform calculations, and make investment decisions in real-time, facilitating timely actions and responses to changing market conditions.

How do analog computers handle complex financial systems in analysis?

Analog computers can directly simulate the continuous behavior of financial variables, allowing for more accurate modeling and analysis of complex financial systems and market dynamics.

Why are hardware-level interactions valuable in financial analysis?

Hardware-level interactions allow analysts to interface analog computers with physical data sources, enabling real-time data collection and analysis for more accurate and timely financial analysis.