Artificial Intelligence (AI) has revolutionized the banking industry, providing numerous advantages that enhance operational efficiency, improve customer experiences, and enable better decision-making. With its ability to analyze vast amounts of data, automate processes, detect fraud, and personalize services, AI has become a game-changer for banks worldwide.

Artificial Intelligence has transformed the banking industry, offering numerous advantages that enhance customer experiences, improve operational efficiency, and strengthen security measures. From delivering personalized banking services to detecting and preventing fraud, AI empowers banks to streamline processes, make data-driven decisions, and adapt to the evolving needs of customers.

Embracing AI technology enables banks to stay competitive in a rapidly changing digital landscape. In this article, we will explore the key advantages of artificial intelligence in banking and how it transforms the way financial institutions operate.

What is artificial intelligence (AI)?

Artificial Intelligence, a branch of computer science, focuses on the development of intelligent machines capable of performing tasks that traditionally require human intelligence. In the banking sector, AI technologies have gained significant traction due to their ability to process and analyze large volumes of data with speed and accuracy, thereby transforming various aspects of banking operations.

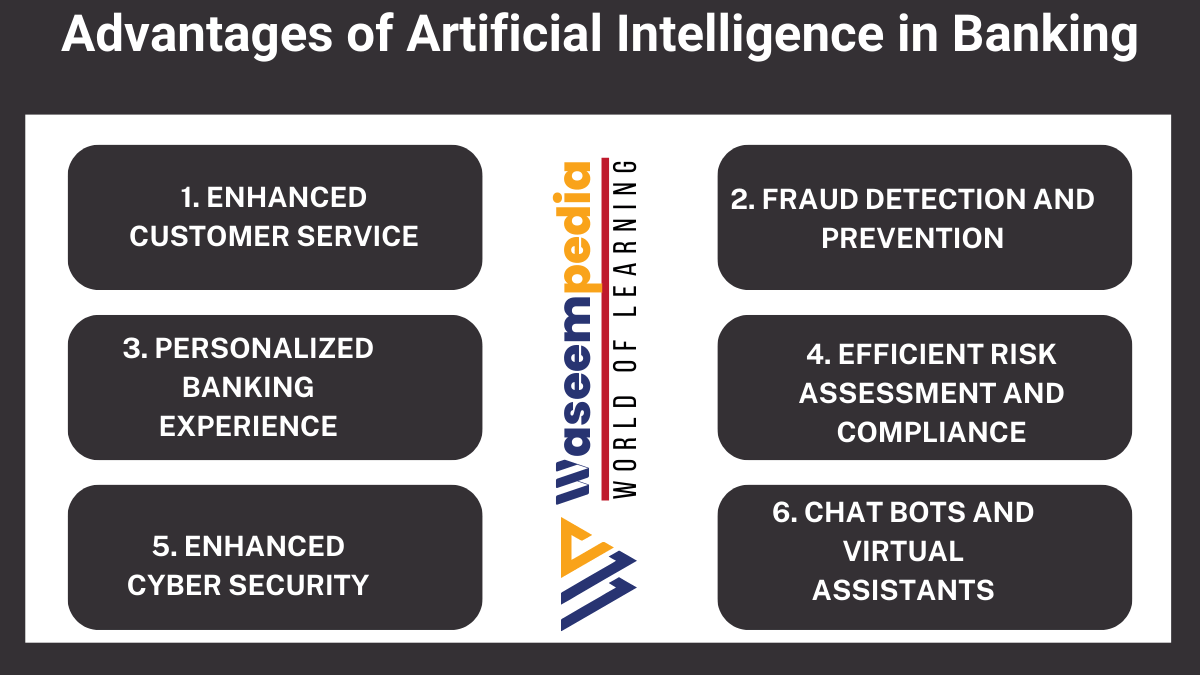

8 Advantages of Artificial Intelligence in Banking

Advantages of Artificial Intelligence in Banking are as following:

1. Enhanced Customer Service

One of the primary advantages of AI in banking is its ability to deliver enhanced customer service. AI-powered chat bots and virtual assistants can handle customer inquiries promptly, providing round-the-clock support. These intelligent systems can understand customer queries, offer personalized assistance, and even perform transactions. By leveraging AI, banks can improve customer satisfaction levels, reduce wait times, and enhance overall service quality.

2. Fraud Detection and Prevention

Fraud is a critical concern for banks, and AI plays a crucial role in detecting and preventing fraudulent activities. AI algorithms can analyze vast amounts of historical transaction data, identify patterns, and detect anomalies in real-time. By monitoring transactions, AI systems can flag suspicious activities, potentially preventing fraud before it occurs. This proactive approach helps banks safeguard customer accounts and financial assets while minimizing losses.

3. Personalized Banking Experience

AI enables banks to deliver personalized banking experiences to their customers. By analyzing customer data, AI algorithms can understand individual preferences, spending patterns, and financial needs.

This information allows banks to offer tailored product recommendations, customized financial advice, and personalized marketing offers. By providing relevant and targeted services, banks can strengthen customer relationships and increase customer loyalty.

4. Efficient Risk Assessment and Compliance

Risk assessment and compliance are crucial aspects of banking operations. AI systems can analyze vast amounts of data, including customer information, market trends, and regulatory requirements, to assess risks accurately.

AI algorithms can identify potential credit risks, assess loan applications, and determine the creditworthiness of customers. Additionally, AI-powered systems can ensure compliance with regulatory guidelines by automating processes and flagging potential violations, thereby reducing compliance-related risks.

5. Process Automation

AI technology enables banks to automate repetitive and time-consuming processes, improving operational efficiency. Tasks such as data entry, document verification, and report generation can be automated, freeing up human resources to focus on more complex and value-added activities.

Automation reduces errors, accelerates processes, and enhances productivity, resulting in cost savings for banks and faster service delivery for customers.

6. Chat bots and Virtual Assistants

AI-powered chat bots and virtual assistants have become prevalent in the banking industry. These intelligent systems can provide instant responses to customer queries, assist with account-related tasks, and offer financial guidance. Chat bots can handle a wide range of inquiries, including balance inquiries, transaction history, and product information.

By incorporating chat bots and virtual assistants, banks can improve customer engagement, provide seamless self-service options, and optimize operational efficiency.

7. Data Analysis and Predictive Insights

AI excels in data analysis, allowing banks to gain valuable insights and make informed decisions. By analyzing large volumes of customer data, AI algorithms can identify patterns, trends, and correlations that can drive business strategies.

Banks can use predictive analytics to forecast customer behavior, predict market trends, and optimize marketing campaigns. These insights enable banks to offer personalized services, identify cross-selling opportunities, and improve their competitive edge.

8. Enhanced Cyber security

Cyber security is a top concern for banks, and AI helps strengthen security measures. AI-powered systems can detect potential security breaches, identify abnormal network activities, and respond swiftly to mitigate risks. By leveraging machine learning algorithms, banks can continuously learn from patterns and anomalies, improving their ability to detect and prevent cyber threats.

AI-powered cyber security solutions provide an added layer of protection to sensitive customer data and help banks maintain trust and confidence among their customers.